Car Insurance Terms That Can Save You Some Money

In Singapore, knowing these motor car insurance terms may save you a couple of hundred dollars as you are shopping for an auto insurance package for your vehicle.

The idea is to know what you need and what you don’t. For example, you may not need a courtesy car or towing/roadside assistance. Adding these into your coverage may cost you a little more than you’ll need to pay for.

So get familiar with these terms now:

Motor Premiums

This is the amount ($) you pay to insure your car from eventualities. Ensure your premiums commensurate with your risk profile. Always make sure that you’re not over-paying for your car insurance (or motorcycle insurance).

Excess Amount (aka Deductible)

Find out the amount that you might be required to bear when a claim is made. Eg. If your claims amount to $2,000 and the deductible is $600, you’ll have to bear $600 while the rest will come from the insurer’s pocket.

Every insurer will impose excess on policies – the higher the excess, the lower the premium charged and vice versa. And each insurer will state their excess amount when they make their offer (quote) to motorists.

No Claim Discount (aka No Claim Bonus / No Claim Entitlement)

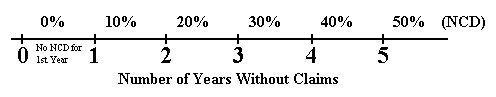

No Claim Discount (NCD) reduces your car insurance premium significantly. If you have an NCD of 20%, you’re given a 20% discount of the premiums that you’re supposed to pay. You are entitled to NCD on renewal if you have not made a claim for a year. This is how NCD is calculated for subsequent years:

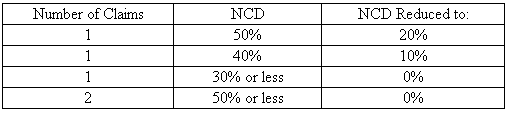

If a claim is made during a policy year while you are still enjoying NCD, the NCD will be reduced at the next policy renewal. The reduction of NCD is computed as follows:

Windscreen Damage

Many insurers provide you with windscreen cover (free of charge) but apply an excess of $100 for each claim. (check insurers’ policy)

Personal Accident Cover

Some insurers offers personal accident covers for you and your passengers as part of their insurance plan. (This may or may not be necessary for you, depending on whether you have an existing personal accident coverage)

Repair Options

Restrictions on repair workshops and new part replacement applies. Usually cheaper premium policy will tend to have more restrictions. This contributes to the advice that the cheapest motor car insurance may not be the best.

Towing/Roadside Assistance

Some insurers provide towing and roadside assistance in their plan.

Courtesy Car

Some insurers provide a courtesy car while your vehicle is under repair.

Click Here to go back to Motor Insurance Singapore Home

Readers who are interested in the above article may also be interested in the sponsored links below: